Hedge fund-grade insights for retail investors.

Investing ideas based on thousands of filings, articles, and forums — distilled by agentic AI into one simple interface.

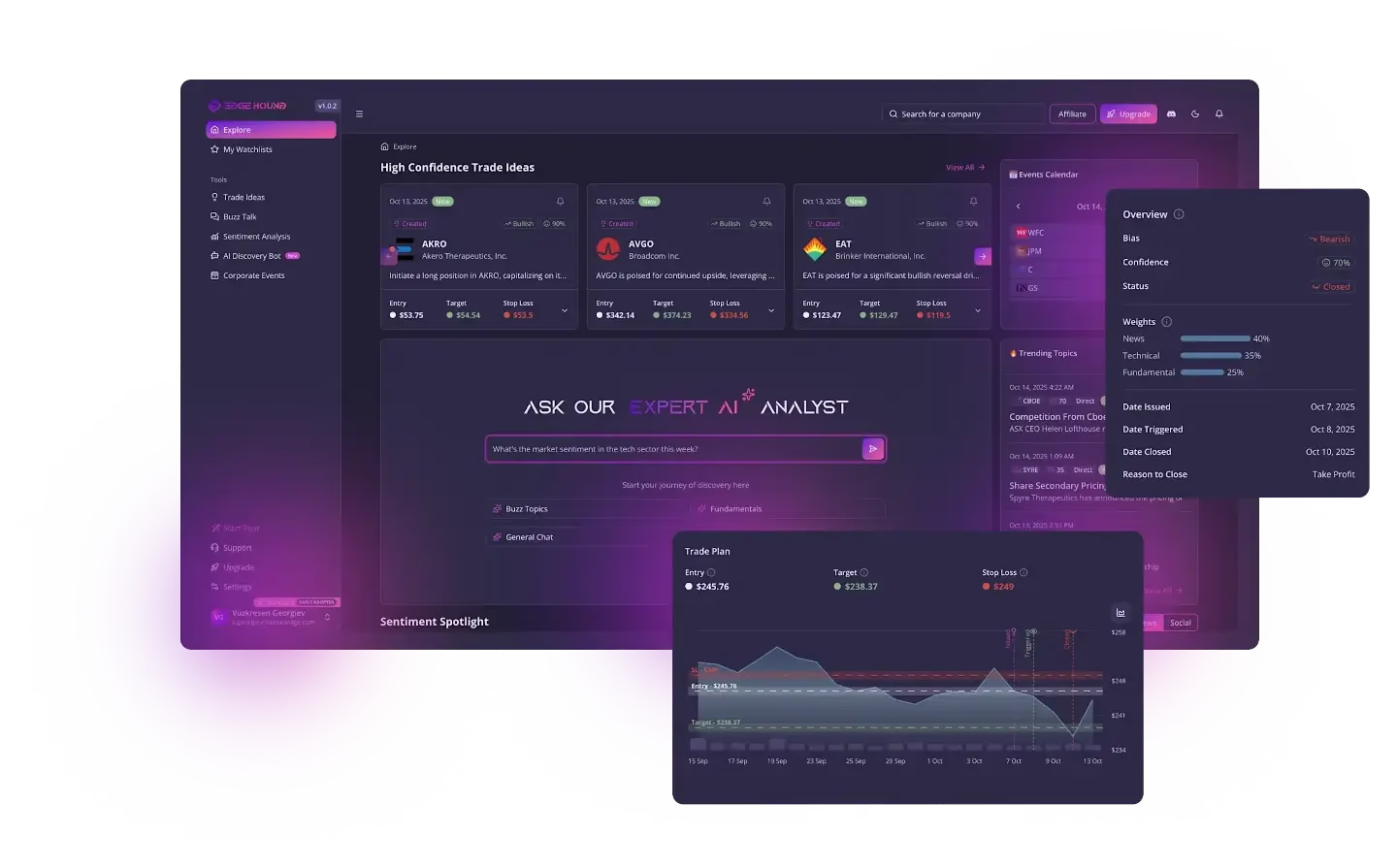

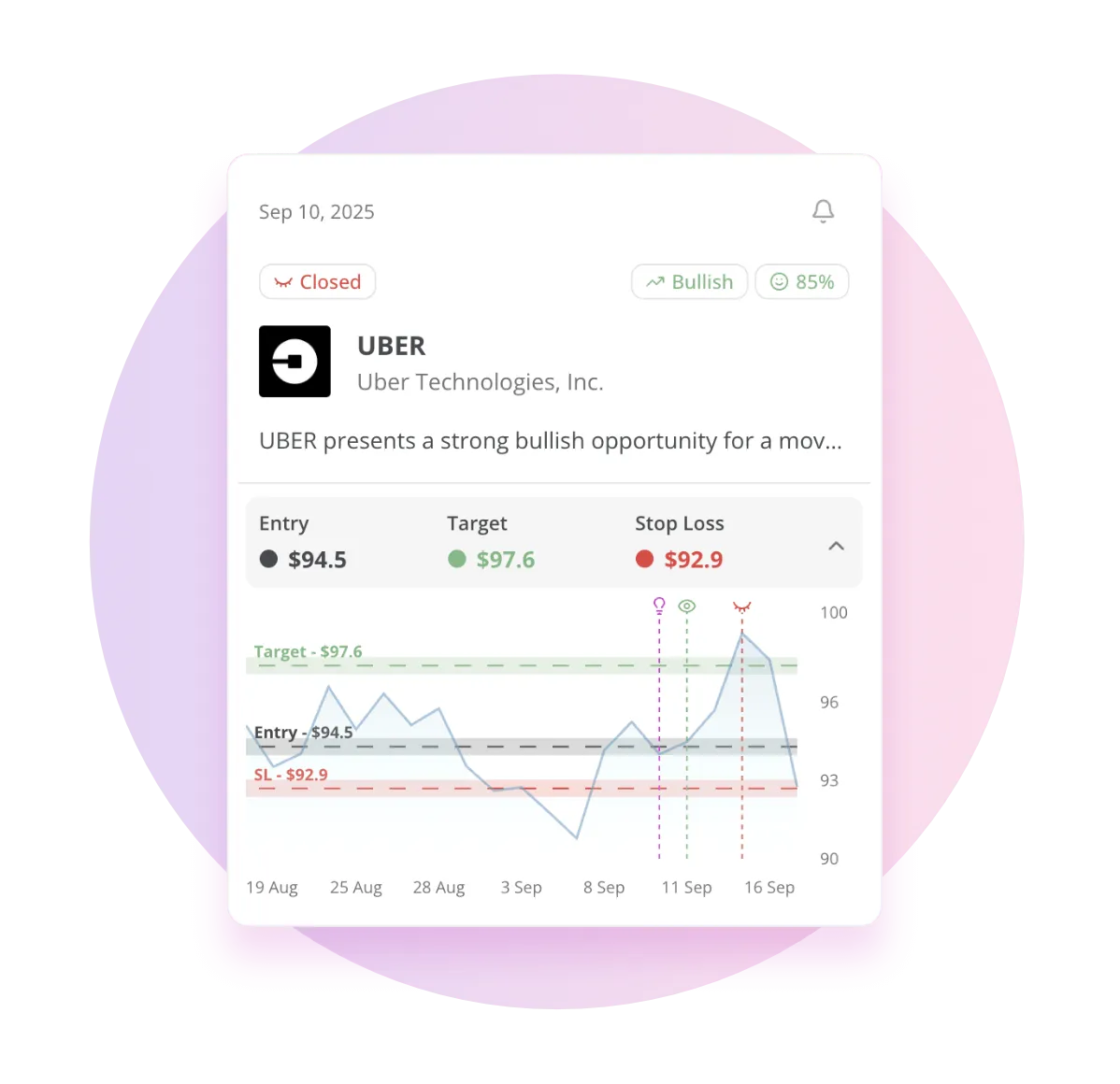

AI-Driven Trade Ideas for Smarter Investing

Fundamental, technical, sentiment, and news analytics — transformed by Finance AGI, delivering the depth and precision of a professional research desk

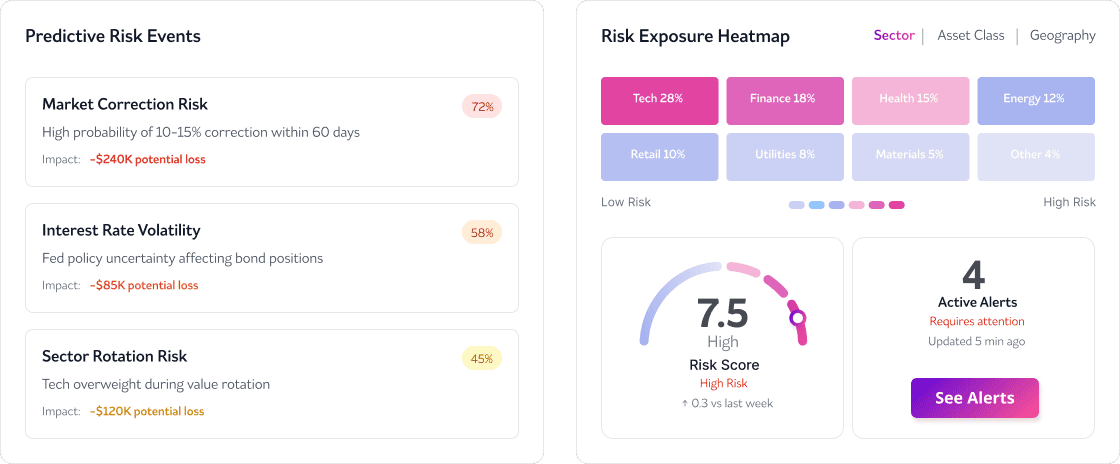

- Detect emerging trends and assess their potential impact on asset pricing

- Leverages advanced AI models to forecast positive and negative price trajectories

- Stay ahead of the market with real-time notifications that signal imminent movements

- Understand potential turning points by simulating micro and macroeconomic variables

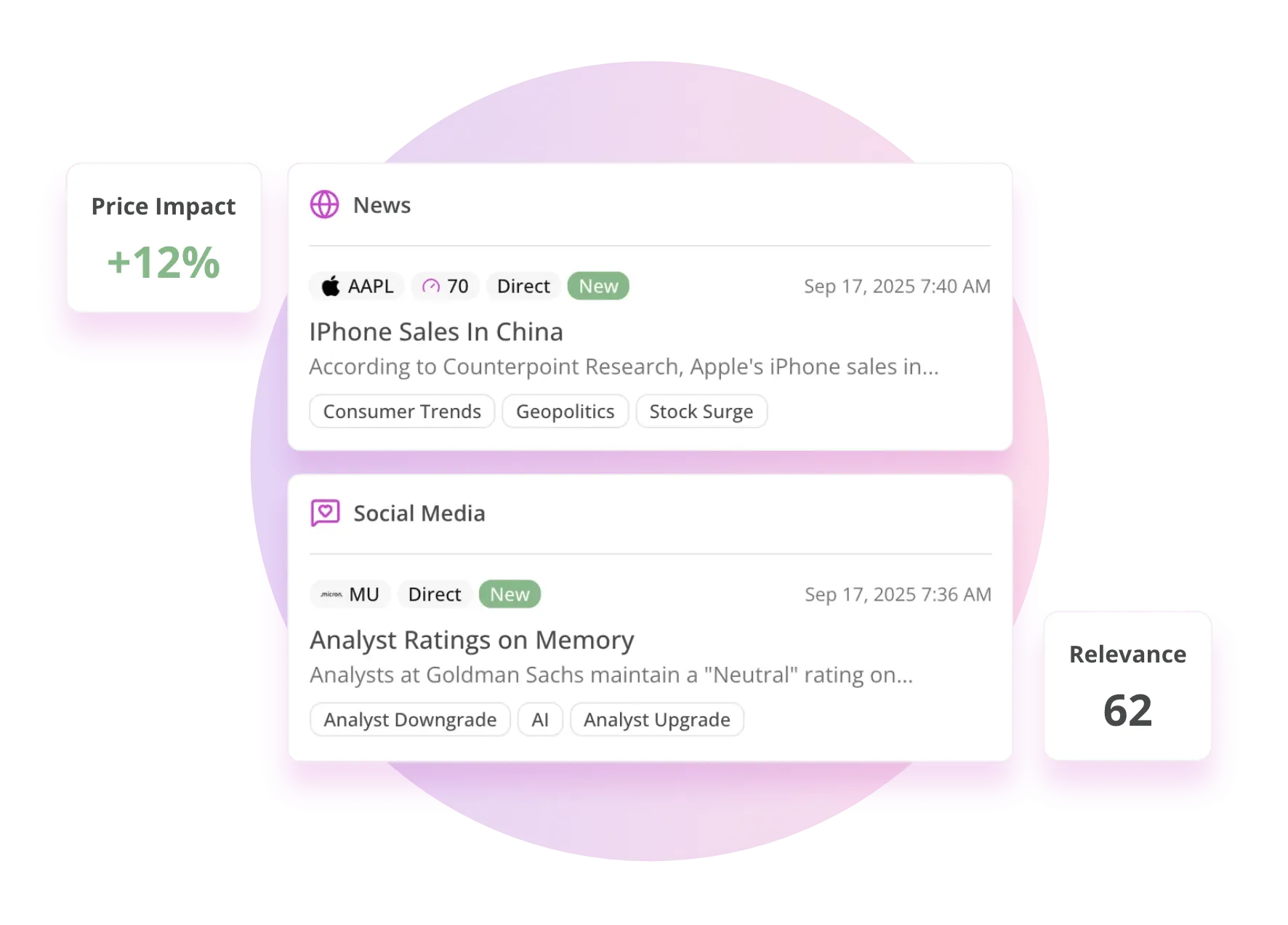

Daily Monitoring of News & Social Streams

Stay ahead by spotting the narratives and conversations shaping tomorrow’s markets

- Spot market-moving topics

- Quantify topic impact across asset metrics

- Get granular, actionable analysis across sectors or asset classes

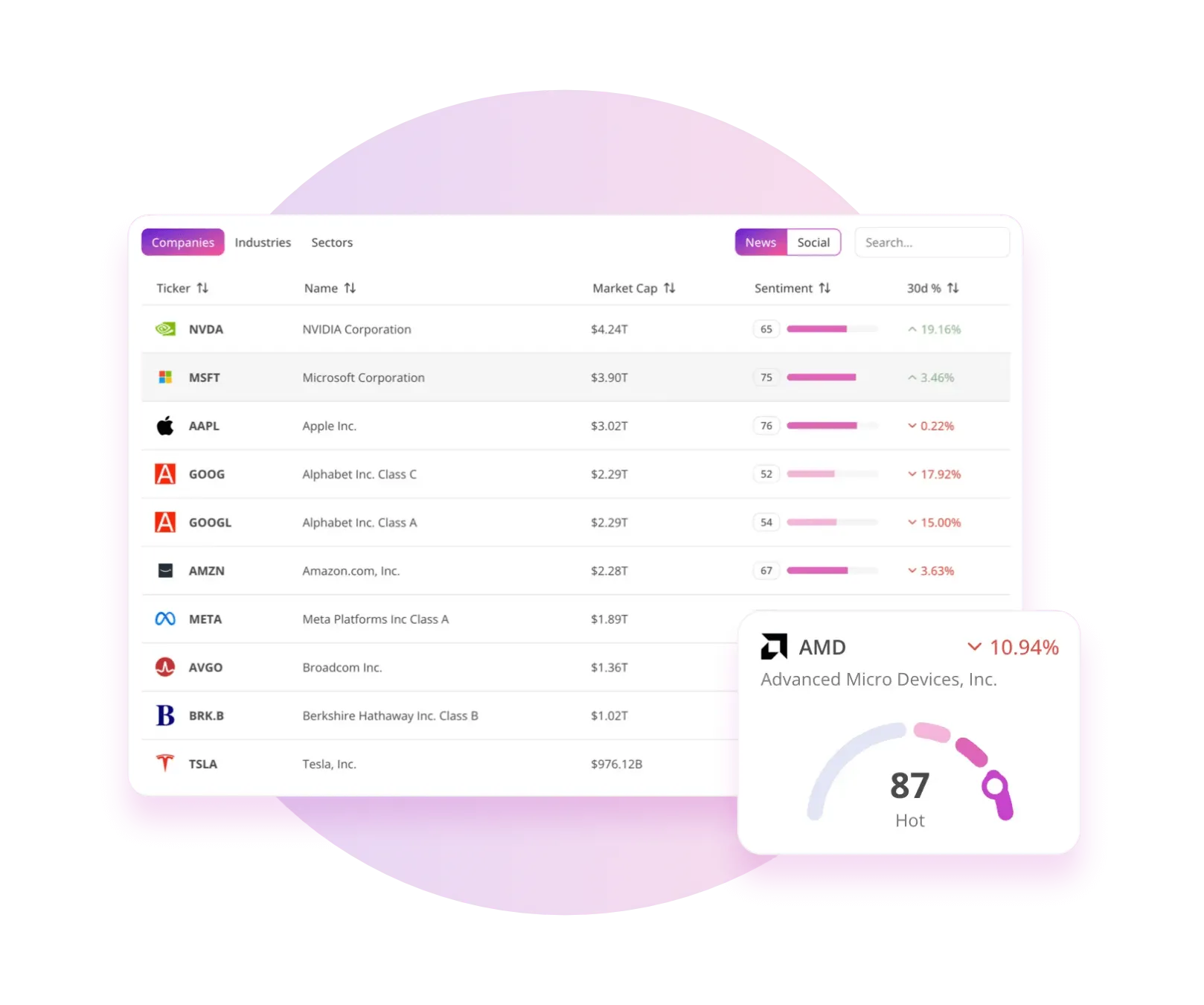

Stay Ahead with Advanced AI Sentiment Analysis

Read the market’s mood in real time and spot opportunities faster than top wealth managers.

- AI-powered sentiment tracking across financial news, social media, and forums

- NLP models that spot fear, greed, or hype before price action reflects it

- Take fast, informed action on market-moving chatter

- Visualize trends across sectors, industries and tickers on various timeframes

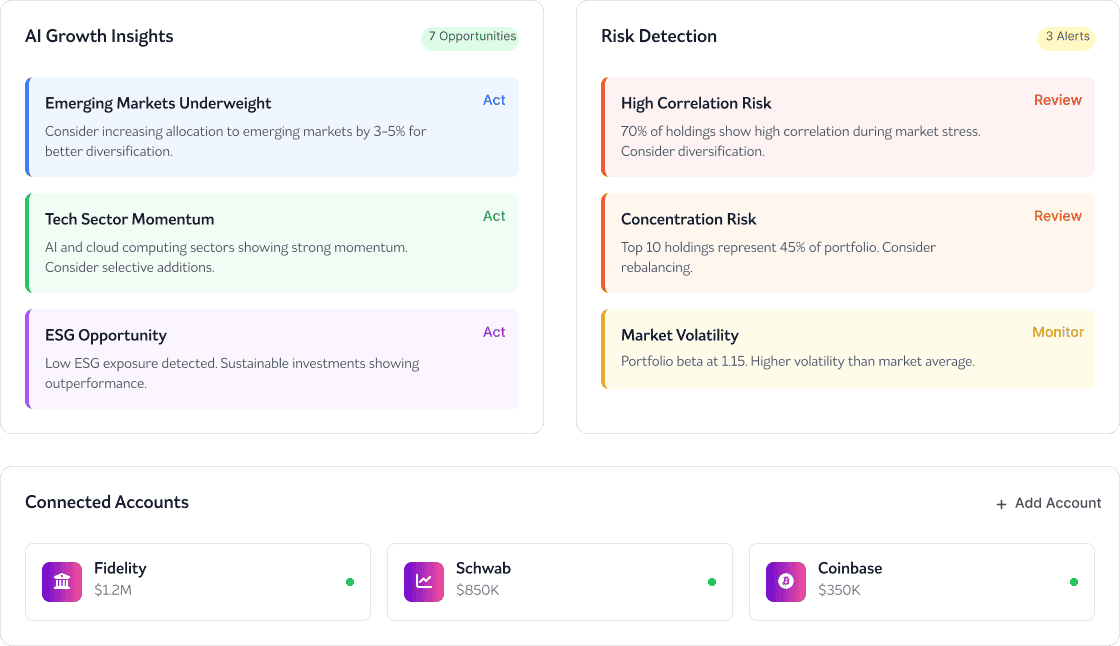

Multi-Agent AI That Sees What Others Can’t

Cutting through noise with insights synthesized from hundreds of data sources.

- Analyze and synthesize insights from hundreds of diverse, high-quality datasets

- No-noise, reliable foundation for decision-making

- Map out relationships across assets, sectors, and data sources

- Detects subtle correlations and global influences that drive market dynamics

- Turn insights into actionable opportunities with zero friction

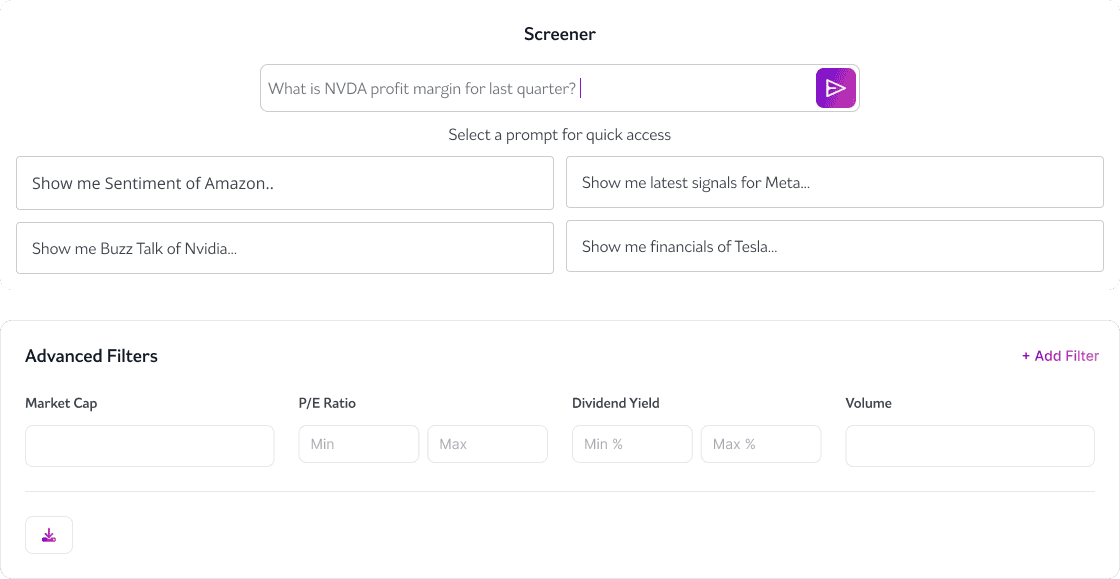

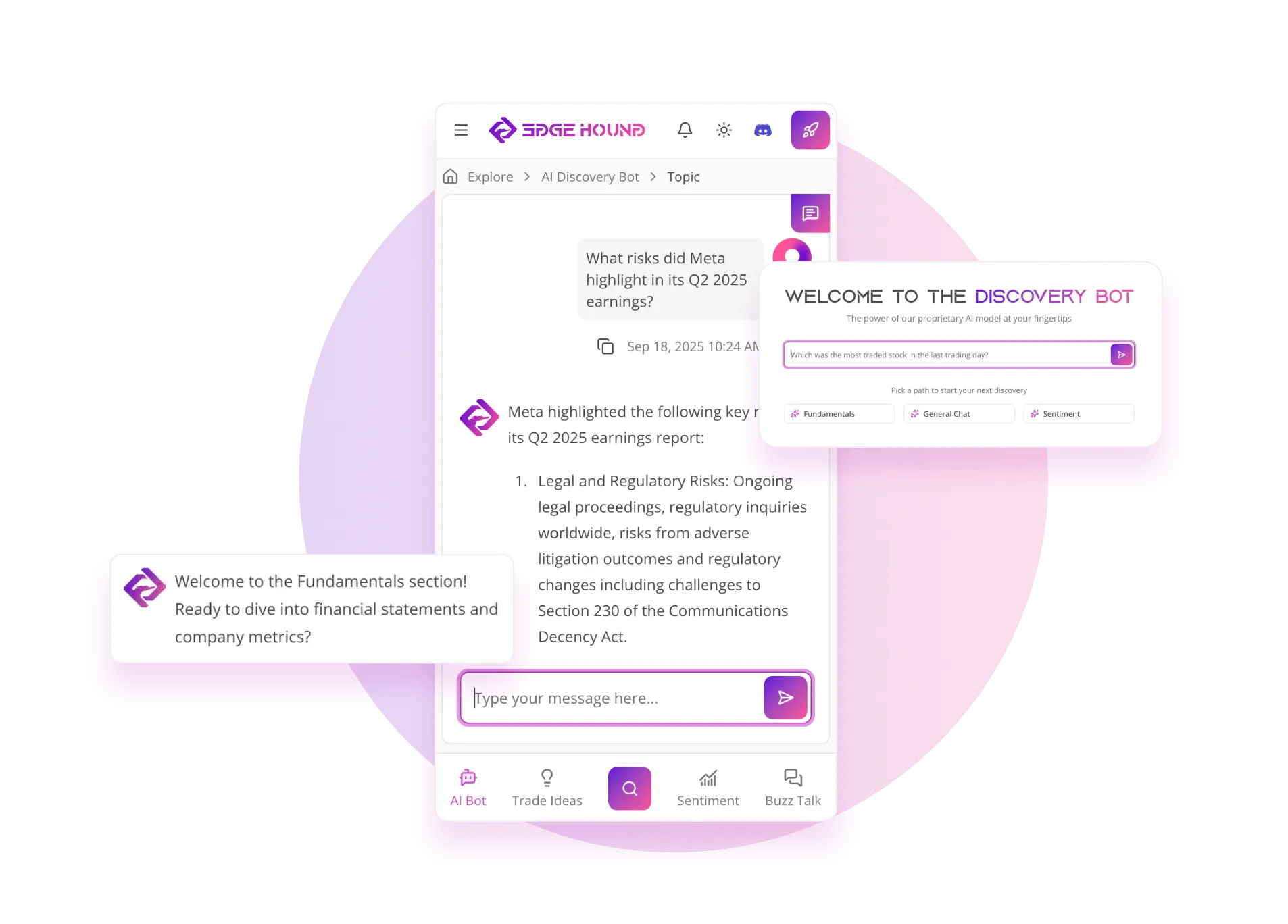

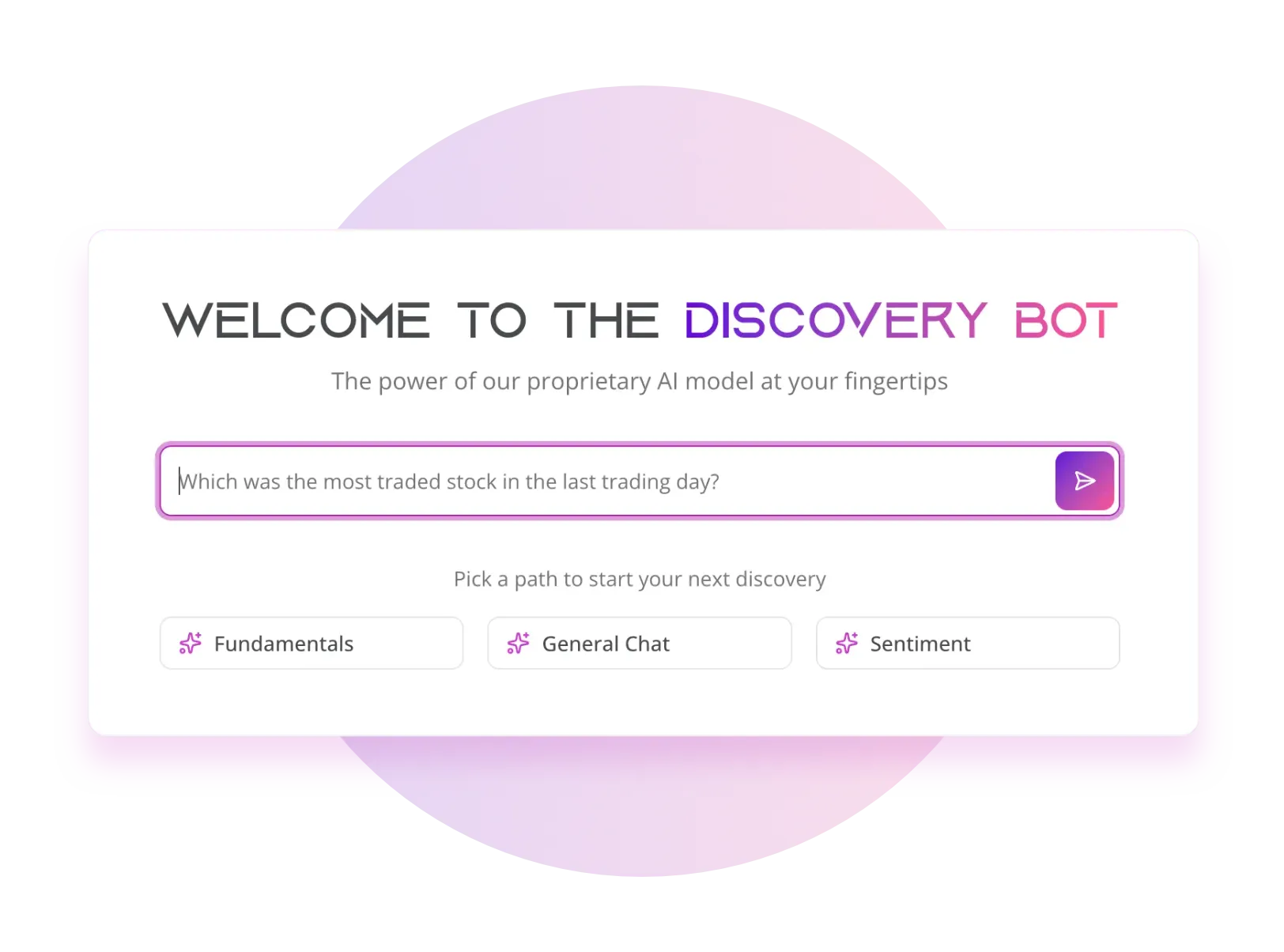

AI Investing Chat, Powered by Proprietary Analysis — Not a Generic LLM

Talk to an AI that understands markets, sentiment, and opportunities the way investors do — powered by Knowledge Graphs to reveal hidden connections, deliver deeper insights, spot early trends, and uncover unseen risks.